Please update your browser.

JPMorgan Chase is committed to advancing sustainable solutions for its clients and within our operations. We are applying our capital, data, expertise, and other resources to help address climate change and promote long-term, innovative solutions for a more sustainable future. Our approach is reflected in an expanding suite of sustainability-focused initiatives across our firm.

Paris-Aligned Financing Commitment

Paris-Aligned Financing Commitment

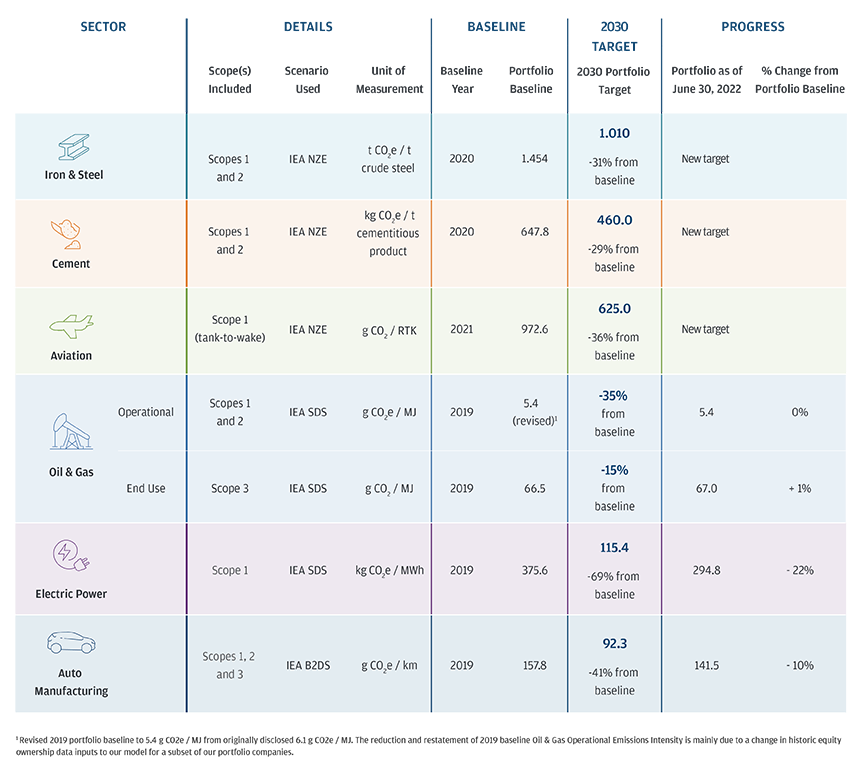

We’ve committed to align key sectors of our financing portfolio with the goals of the Paris Agreement. We’ve developed Carbon CompassSM – our methodology for measuring the GHG emissions of our clients and setting Paris-aligned targets to reduce the carbon intensity of our sector portfolios over time.

Sustainable Development Target

Sustainable Development Target

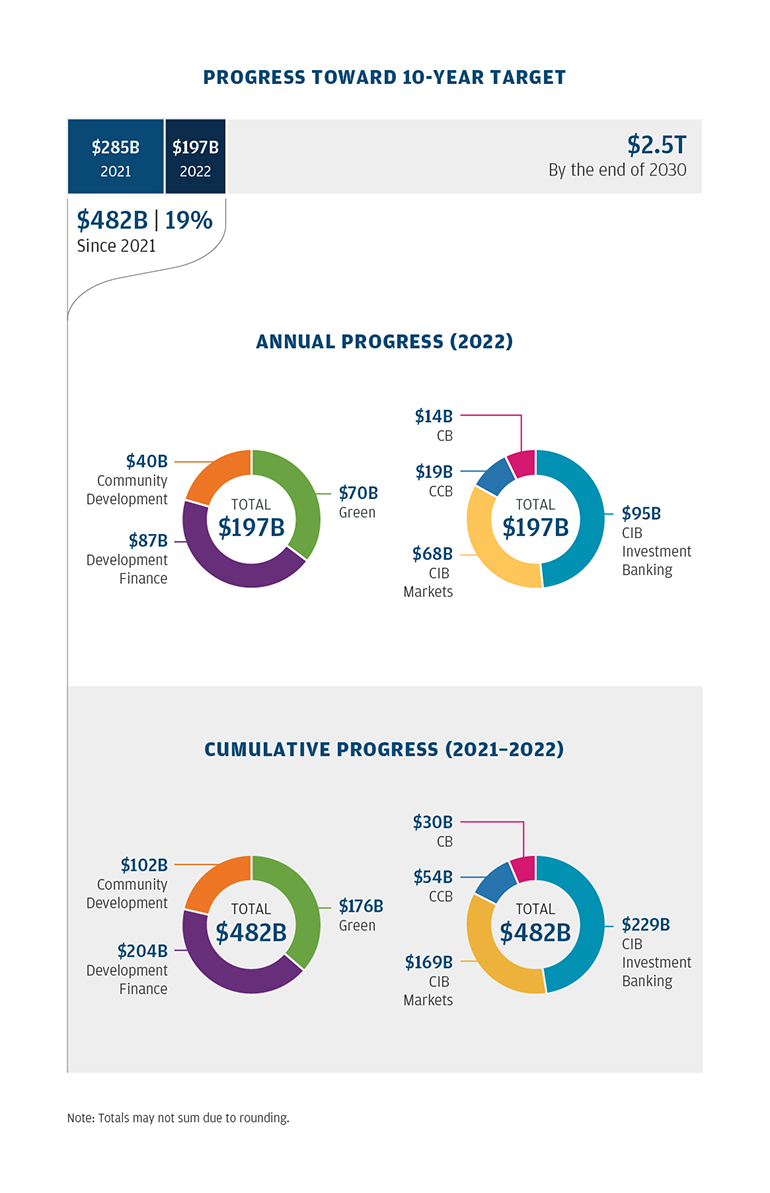

We aim to facilitate $2.5 trillion to address climate change and contribute to sustainable development, including $1 trillion for green initiatives over 10 years – from 2021 through the end of 2030. In 2021, our Firm financed and facilitated approximately $285 billion towards this Sustainable Development Target.

Operational Commitments

Operational Commitments

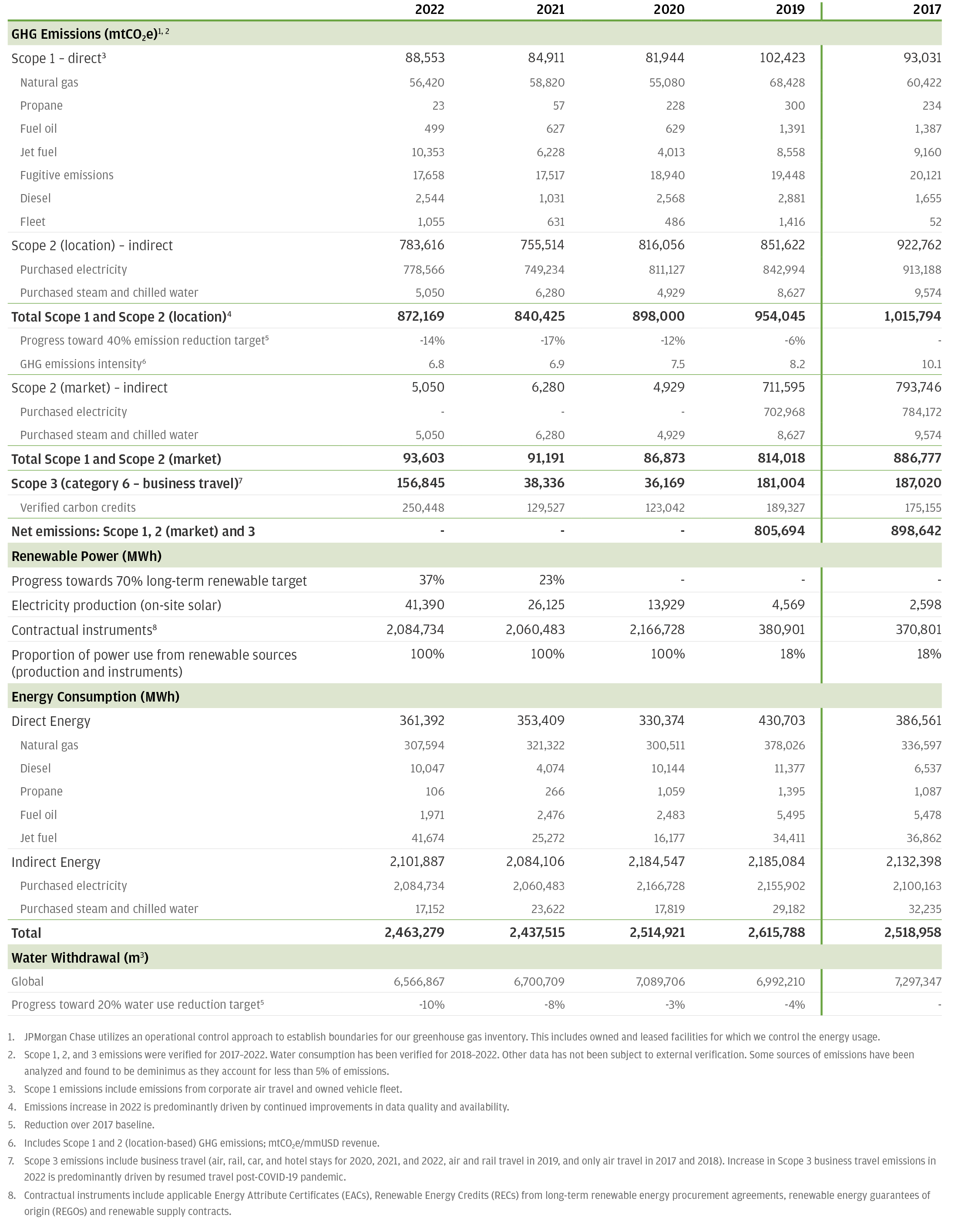

We’ve set a number of targets to drive progress on operational sustainability, including our commitment to be carbon neutral across our operations.

Paris-Aligned Financing Commitment

A key aspect of JPMorgan Chase’s environmental sustainability strategy is how we engage with clients that operate in carbon-intensive industries, with the goal of helping accelerate the low-carbon transition and set a path toward global achievement of net-zero emissions by 2050.

We committed in October 2020 to align key sectors of our financing portfolio with what we consider to be the primary goals of the Paris Agreement, which aims to limit the global average temperature rise to well below 2 degrees Celsius, and ideally to 1.5 degrees Celsius, above pre-industrial levels. To meet our commitment we are setting portfolio-level emissions intensity reduction targets in select sectors that are aligned to science-based emissions reduction pathways.

Introducing Carbon CompassSM

In May 2021, we became the first large U.S. bank to establish 2030 portfolio-level emission reduction targets, which we set for three sectors: Oil & Gas, Electric Power and Auto Manufacturing. We also published our Carbon CompassSM methodology detailing our approach. In December 2022, we expanded Carbon CompassSM with targets for three additional sectors: Iron & Steel, Cement and Aviation.

Over time, we aim to expand this work to address additional carbon-intensive sectors, in alignment with global climate goals and evolving best practices for the financial sector, and to further engage with our clients on their decarbonization journeys. Learn more about our targets, methodology and process here.

Sustainable Development Target

JPMorgan Chase set the Sustainable Development Target with the goal to finance and facilitate more than $2.5 trillion over 10 years—from 2021 through the end of 2030—to advance long-term solutions that address climate change and contribute to sustainable development. In 2022, our Firm financed and facilitated approximately $197 billion toward the Target; $70 billion toward green, $87 billion toward development finance and $40 billion toward community development. Collectively, since 2021, we have financed and facilitated $482 billion toward our Target, including $176 billion toward our $1 trillion green target.

Read more in the 2022 ESG Report.

Our Sustainable Development Target aims to grow and strengthen our business activities across three important areas:

- Green: Aiming to drive climate action, clean energy, and sustainable resource management, with a focus on accelerating the deployment of solutions for cleaner sources of energy and facilitating the transition to a low-carbon economy. We are targeting $1 trillion toward this area by the end of 2030.

- Development Finance: Working to support socioeconomic development in emerging economies, with a focus on mobilizing capital to advance the United Nations Sustainable Development Goals.

- Community Development: Striving to advance economic inclusion in developed markets, with a focus in the United States on Low-to-Moderate Income individuals and communities and closing the racial wealth gap among Black, Hispanic and Latino individuals and communities. This includes many of the actions we are taking as part of our Racial Equity Commitment.

To learn more about the criteria for determining what business activity is eligible to count towards the target, see Our Approach to Our Sustainable Development Target in the 2022 ESG Report.

Operational Commitments

To drive progress on our operational sustainability objectives, we’ve set a number of targets:

2022 Progress

Read about our latest efforts in the 2022 ESG Report.

To further accelerate JPMorgan Chase’s operational sustainability efforts, the Firm has signed long-term agreements to purchase high-quality, durable, carbon dioxide removal (CDR). These agreements are expected to enable the Firm to match every ton of its unabated direct operational emissions with durable carbon removal by 2030. Learn more about how JPMorgan Chase is helping to speed and scale the growth and development of CDR technologies here. Plus, read about JPMorgan Chase’s approach to helping strengthen the voluntary carbon market here.

2022 Environmental Data